Robo-advisors like Emperor Investments are becoming more popular investment strategy among millennials, here are what you need to know about Robo – advisors and why you should consider starting with one. Perhaps the robots are finally taking over the world.

In my early days of investing, I started with a Robo advisor. It was very convenient and required less effort to achieve the same result. We mentioned this in our article on 4 investing ideas for beginners.

At the end of this article, you will understand Robo-advisors, know their advantages and disadvantages and a review of emperor investments.

Table of Contents

Things to understand first before you read

- Asset allocation and diversification do not guarantee a profit or protect against a loss in a declining market.

- Rebalancing/Reallocating can entail transaction costs and tax consequences that should be considered when determining a rebalancing/reallocation strategy.

- Risk tolerance is an investor’s general ability to withstand risk inherent in investing. The risk tolerance questionnaire is designed to determine your risk tolerance and is judged based on three factors: time horizon, long-term goals and expectations, and short-term risk attitudes. The adviser uses their own experience and subjective evaluation of your answers to help determine your risk tolerance.

- The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value-weighted index with each stock’s weight in the index proportionate to its market value. Indices are unmanaged and investors cannot invest directly in an index.

- Mutual Funds and Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

- Screenshots are hypothetical examples used for illustrative purposes and do not represent the performance of any specific investment or product.

Now that we got that out of the way, time to get to business.

What are Robo-advisors?

Robo-advisors vary from brokerage to brokerage but are predominantly digital services that prepare automated financial services based on your preference, without human interaction. Companies do this through the use of complex computer algorithms and advanced software. Here are a few services that a Robo-advisor may provide:

- Automatically select investments and create a diverse portfolio (based upon your preferences)

- Manage retirement accounts, such as your 401k

- Make changes to your investments to align your portfolio back to a target allocation of stocks and bonds

- Automatic rebalancing

- Tax optimization (reducing your tax bill through a process called tax-loss harvesting)

- Weigh your priorities (time, risk tolerance, financial goals) opposed to market conditions, market shifts, etc

How do Robo-advisors work?

Though each Robo-advisor is different, they usually operate very similarly: You will first complete an examination that will gauge your investment needs as well as your risk tolerance. The Robo-advisor automatically builds a diversified portfolio of funds. Other, human professionals, consistently monitor the market and all rudimental investments to make certain that your portfolio is rebalanced (an algorithm does this). Many of these Robo-advisors will include access to a professional who can also help and provide their recommendations for reaching your goals. Now you sit back, log into your account from time to time and track your progress, add contributions, and continuing to work towards your goals.

Can technology be trusted? Is it new?

These online Robo-advisors are not very new. They have been in the market for almost two decades now and they have been shown to be quite reliable.

They have been replacing the middle man financial advisor since 1999. There can, however, be a case made for human advisors and in fact, as mentioned earlier, several companies that have Robo-advisors also provide the services of a financial advisor. These professionals can help the investor from making reckless decisions when the market is doing something odd or under any other special circumstances.

Why Robo-advisors are worth a consideration

- The cost is very reasonable compared to other alternatives, such as financial advisors, who charge anywhere from 1% to 2% of your assets under management, which is much more than the Robo-advisors’ 0.15% to 0.6%. Many times, these Robo-advisors also end up saving you some money through tax-loss harvesting, which ends up in paying the fee for the Robo-advisor.

- Robo-advisors rebalance quickly and easily. Due to this, they can also do it frequently, whereas if you were in complete control of your account, it would take much more time, effort, and hassle. Rebalancing makes sure that, at the very least, your risk level stays the same. On average, however, rebalancing can help improve your returns. Yale University Chief Investment Officer, David Swenson, found that rebalancing earns an average of .40% more each year, over 10 years than portfolios that are not rebalanced.

- Tax-loss harvesting is much better accomplished by computers than it is by humans. It is a strategy where losing investments are sold in order to create tax losses, offsetting taxable gains in other areas. TLH, like rebalancing, may also eventually result in an increased return on investment. This combined with rebalancing evidently results in an offset to the fee of the Robo-advisor and sometimes results in an even higher return.

- They are extremely convenient. It is impossible to overlook this. Robo-advisors invest for you almost completely automatically, leaving you time to do anything else with your life and finding other avenues to increase your wealth.

Why not use a Robo-advisor

- You like to invest on your own. You could find Robo-advisors to be boring and maybe you want to pick your own investments. If you have any sort of interest in researching your own stock choices, managing your portfolio, or hitting it big with some stock, these Robo-advisors are not great.

- You want to beat the market, not match it. You want higher returns, consistently. This is extremely difficult, and even individuals such as Warren Buffet believes he cannot beat the market anymore when answering a question on whether an investor should invest in Berkshire Hathaway or the S&P 500 index. To beat the market, you need immense skill. Though challenging, it is possible, but it is only something a human investor can do. A Robo-advisor usually can’t beat the market. Most will probably earn a little bit less than the overall market. In times where the market dips, however, the robot-advisor should deal you fewer losses.

- We don’t know how Robo-advisors will perform in a bear market. There is no track record that can show how these advisors will perform in a declining market for a long period of time. A recession will result in large losses, and this is where a human could beat the Robo-advisor more consistently.

Emperor Investments – Quick Summary

PROS: – Pure equity investing portfolios (100% stock portfolios) – Goal-based investing platform – Dividend reinvesting – No hidden ETF fees – Human aspect and support

CONS: – Annual fee is higher than other Robo-advisors – There isn’t a lot of diversification across investment products

This is a good chance to chest out our article that tackled whether you even need bonds in your portfolio.

What is Emperor Investments?

Emperor Investments is a brand new, innovative type of Robo-advisor. Unlike most, which invest in several large, index-based ETFs, Emperor Investments blends mean-variance optimization along with fundamental analysis.

Mean-variance optimization is a technique that suggests to investors to look at the history and performance of a particular stock, and use that important information to calculate the risk associated with it and the possible return on investment. The investor then mathematically determines how that stock impacts the rest of his portfolio.

Fundamental analysis means evaluating a stock based on certain criteria, (e.g. financial statements, the effectiveness of the company’s management, etc.) to determine its intrinsic value. Basically, the purpose is to determine if the stock is undervalued or overvalued when it comes to its current price.

How exactly do they blend these two methods? Emperor Investments has a three-step approach when picking stocks. Every quarter the first two steps are run.

First, their technology sifts through every stock on the U.S. exchanges. The exact selection criteria are proprietary, but dividend payment history is crucial in the Emperor’s methodology – they will ONLY invest in companies with an unwavering dividend payment record. Second, the stocks selected by the technology are further vetted by Emperor’s team of security analysts who look for things technology can’t assess yet, such as quality management.

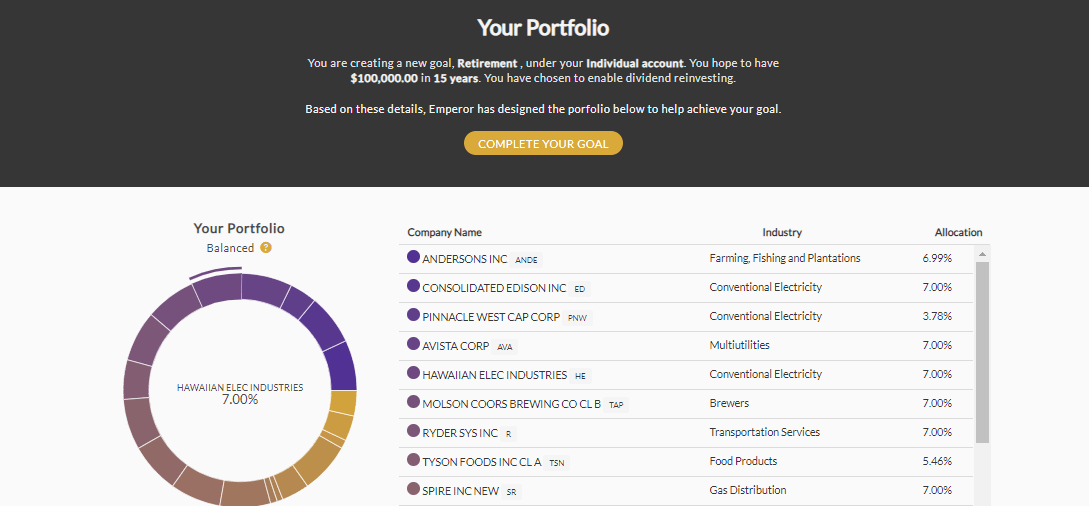

The final step occurs when a new client creates a goal on the Emperor platform. This is where mean-variance optimization kicks in. Based on your investing preferences and the time horizon of your goal, Emperor will recommend a portfolio of stocks from the pool determined in the first two steps. During this time they also consider stock prices, buying less overvalued companies and more undervalued companies for you.

In summary, Emperor Investments combines advanced technology and opinions of humans to get you a portfolio suited to your specific needs.

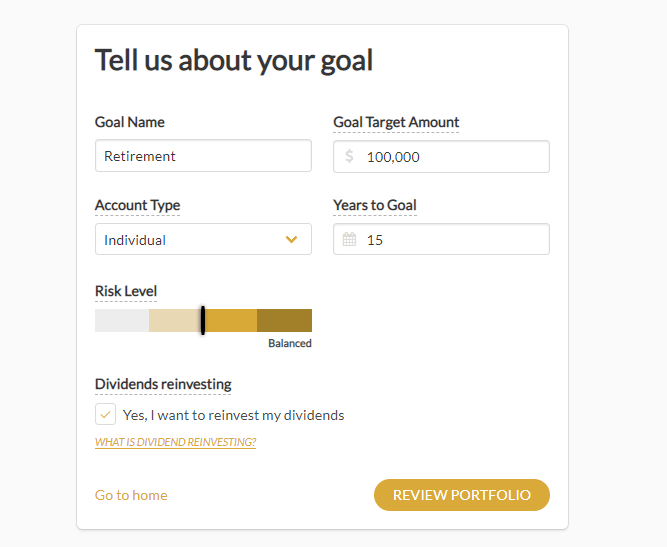

Goal Step 1

How much does Emperor Investments Cost?

With Emperor Investments, the fees are very simple and more transparent than some other Robo-advisors; you need to have a minimum deposit of $500 and pay a 0.60% annual cost. Obviously that is significantly higher than most Robo-advisors out there at first glance. However, it is still competitive and, more importantly, there are no hidden ETF fees which are common among other Robo-advisors.

Where Emperor Investments really differentiates itself from every other Robo-advisor out there is that the annual cost goes down the more you invest. At >$900k, it only costs only 0.20%. So for high-income earners, this is a sweet deal.

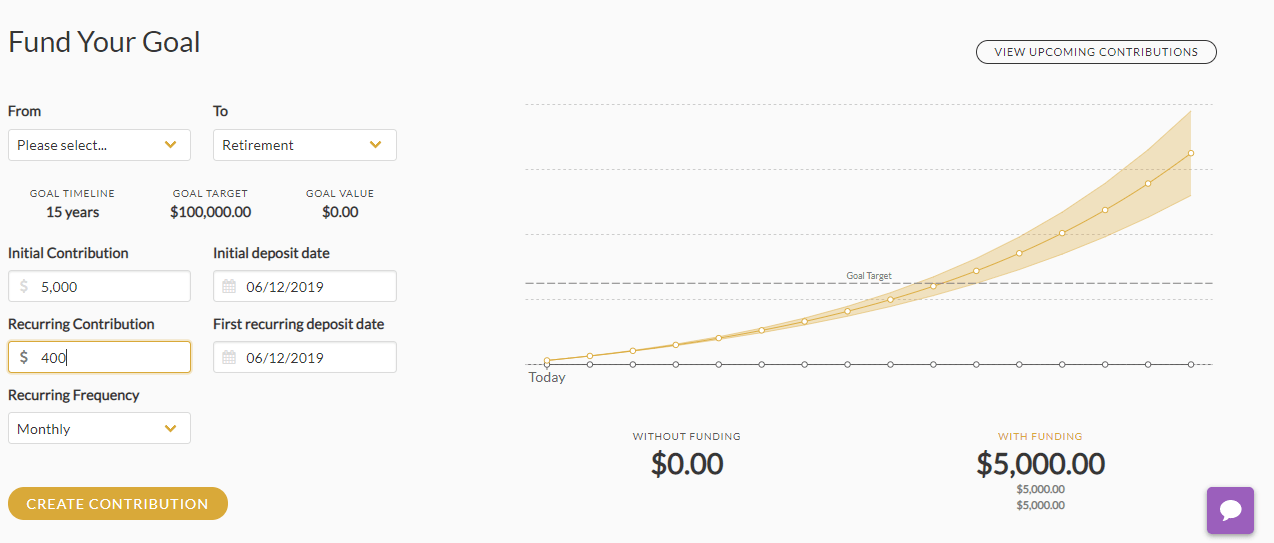

Goal step 2

Diversification with Emperor Investments

Emperor Investment portfolios are personally tailored and will consist of 100% stocks. Many investors may see this and quickly suggest that it is far too limiting.

That does not, however, take away from Emperor Investments’ great stock investing capabilities. If you are an investor who feels limited by this aspect of Emperor Investments, you can choose to invest in stocks through Emperor Investments and use some other Robo-advisor or broker for the rest of your investment strategy.

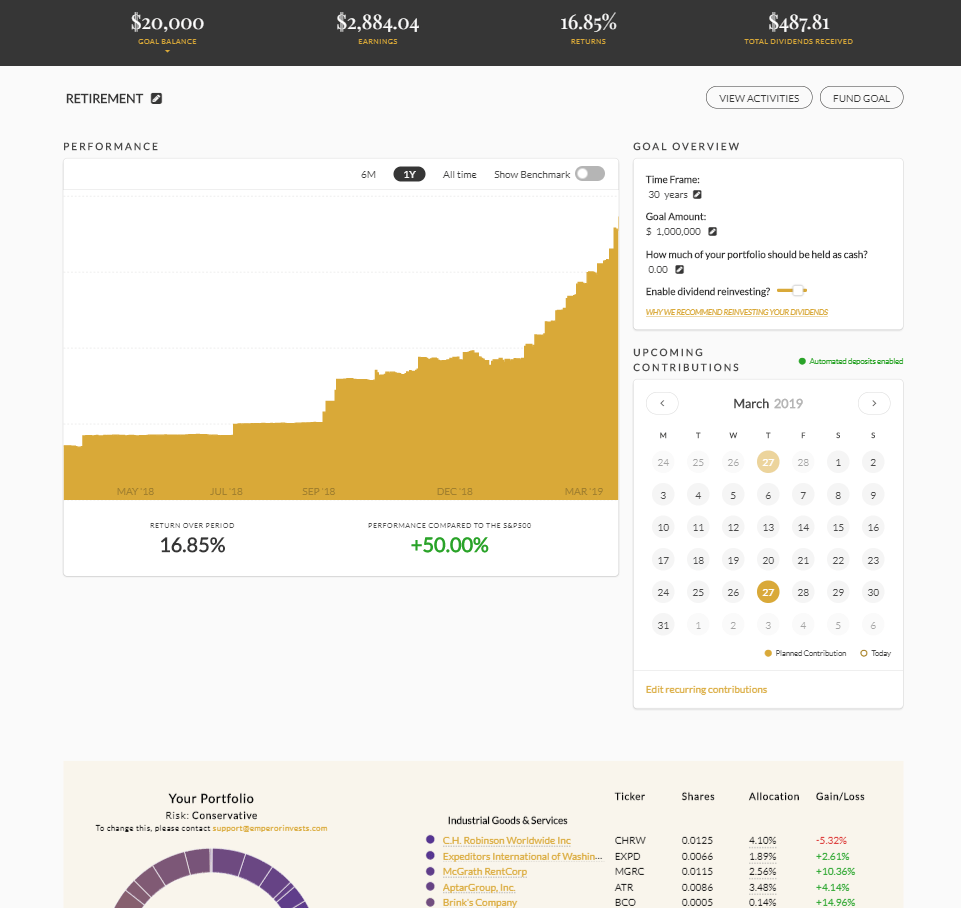

Goal Details Page

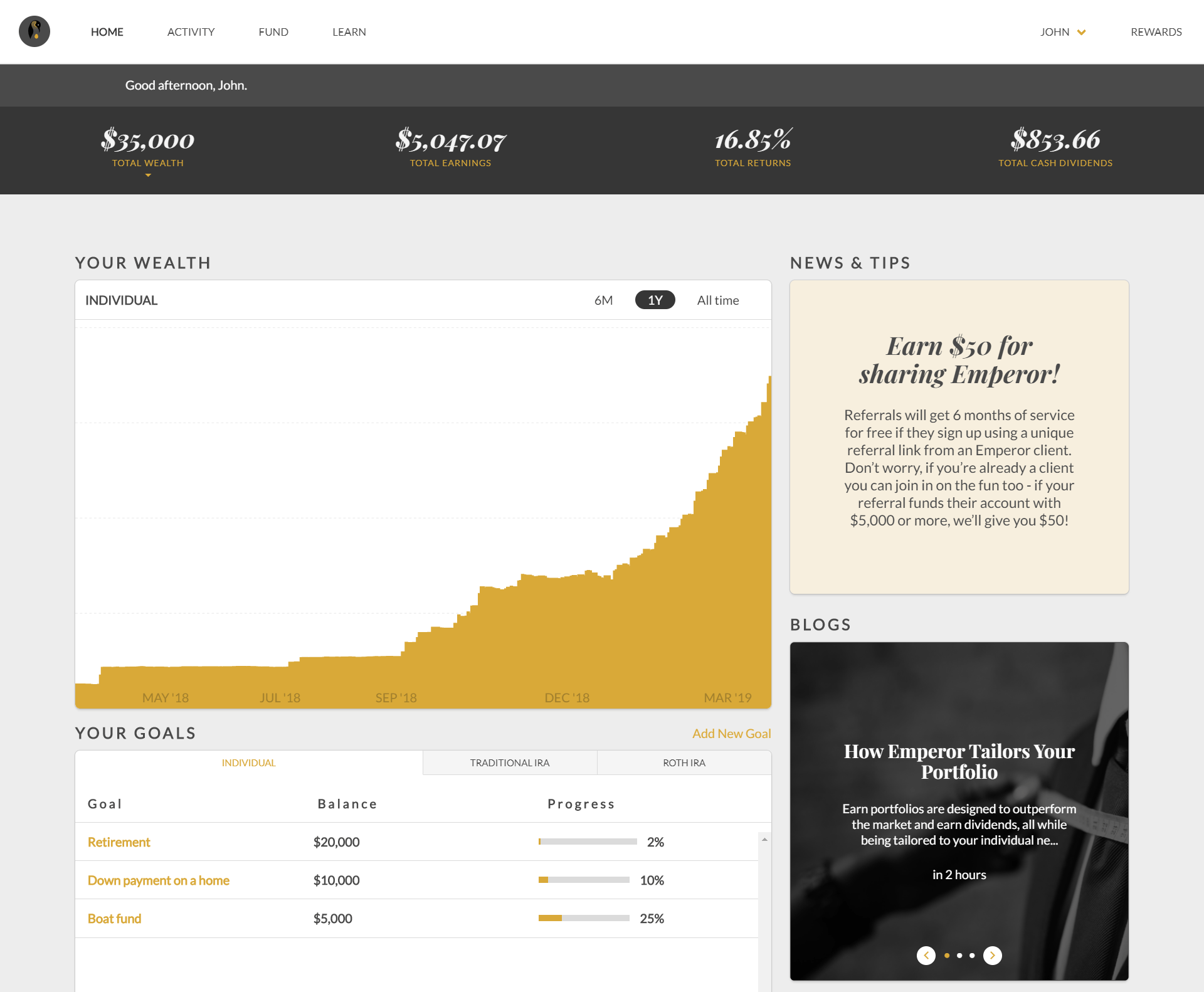

Interface and Usability

Emperor Investments is extremely easy to use. All you need to do to begin using it is enter some basic information such as age, total assets, primary source of income, etc. It then automatically creates your portfolio based on your answers.

The portfolio will consist of holdings in healthcare, utilities, chemicals, food and beverage, and personal and household goods.

And all you will need to get started investing is $500.

Home Page

Different Types of Accounts and Services

Emperor Investments is completely focused on equity investing only. There are absolutely no ETFs or mutual funds. Some investors may, again, find this limiting and/or be of the opinion that investing in index funds is safer but, Emperor Investments gives you more control as you are directly holding companies. This increase in responsibility is not only exciting but also beneficial in that you won’t mindlessly invest in random index funds; you will need to think about each investment and company you invest in.

The majority of the other Robo-advisors are completely or nearly completely passive. Emperor Investments is geared toward having a good amount of autonomy while providing you with more control and customizability. And the stock options available should all be good options (though you should still do some extra research). This is thanks to Emperor Investments technology that scans for reliable, dividend-paying stocks that are not overpriced, followed by further evaluation from humans.

Portfolio Summary

So, is Emperor Investments Worth it?

Emperor Investments gives investors the chance to experience an equity-based investing strategy. You get to directly hold companies instead of ETFs, which you may see as an advantage or a disadvantage.

Though the fee of 0.6% is a little bit high, you get a personalized experience with a human touch, along with no hidden fees.

If you sign up through our link, you get to try it out for 6 months absolutely FREE!

I am a pulmonary and critical care doctor by day and personal finance blogger/debt slaying ninja by night.

After paying off close to $300,000 in student loan debt in less than 6 months into my real job, I started on a mission to help others achieve the same. There is no magic to this than to strap up and get it done. Some of the ways we achieved this include side hustle, budgeting, great negotiation skills, and geographical arbitrage.

When I was growing up, common knowledge in Nigeria is that there is one thing you cannot trust anyone else with, and you guessed it – your money.

Being frugal came easily to me based on my background. However, the concept of building wealth did not solidify in my mind until when I finished medical school. I wish I knew what I know now when I was 14. Still, I don’t know enough and I am constantly learning to improve my knowledge.

My goal is to reduce financial illiteracy among young professionals. I am catering to the beginners – babies and toddlers in financial literacy.

Leave a Reply