HEALTH SAVINGS ACCOUNT VS FLEXIBLE SPENDING ACCOUNT

When it’s the time of the year to elect our benefits, we are often confronted with the options, do you want to enroll in FSA, what about the HSA? The result is a staring competition, with an awkward silence that ultimately leads to you saying no to the question. Why did you say no? Mainly, this is due to lack of knowledge on the subject matter. If you don’t understand the benefit of any plan, the safest answer most logical people with give is – No. I know that’s what I do.

This is not really a debate, but a comparison of the saving accounts we can utilize for our health care cost while enjoying some tax advantages at the same time. Hence, the HSA vs FSA angle.

Table of Contents

TABLE OF CONTENTS

- Types of health spending accounts

- What is an HSA

- Benefits of HSA

- HSA contribution rules and eligibility

- What is HDHP

- Requirements of HDHP with chart

- Annual tax deduction for HSA in 2019

- What is FSA

- Benefits of FSA

- Constraints of FSA

- HSA VS FSA showdown

- What are qualified expenses

- Summary

- Subscribe and get free budgeting E-book on the homepage so you can have more money to put in your HSA or FSA

Pin me on Pinterest

Types of health spending accounts.

Before we dig deeper, let us first understand some concepts. HSA and FSA are not the only way to offset health care costs.

Here are various programs designed by the IRS to give us tax advantages to help with those health care costs.

- Health Savings Accounts (HSAs).

- Medical Savings Accounts – i.e Archers MSA

- Health Flexible Spending Arrangements (FSAs).

- Health Reimbursement Arrangements (HRAs).

We will zone in on the HSA VS FSA accounts as those are the most commonly offered tax breaks we are most likely to encounter.

Let us start with the HSA

What is an HSA (health savings account?)

Simply put: HSA are tax advantaged accounts that help employees meet their medical care cost.

A health savings account (HSA) utilizes the benefit of a high deductible health insurance with a tax-favored savings account. Dollars in the savings account can help pay the deductible. Once the deductible is met, the insurance will then start paying. The remaining funds in the savings account earn interest and it’s yours forever until you are ready to use it. The is the only true triple tax-advantaged account. It has been referred to as the stealth IRA. Here is more reading on HSA.

What are the benefits of HSA?

Like many of the healthcare spending accounts, there are many benefits to having an HSA account. Let us go into the most important ones. Be ready to be amazed.

You get a tax deduction

This is the most important part of the plan. I know what you are concerned about. But, but, but.. I don’t itemize my deductions. Especially, in light of the recent tax laws. Rejoice and be glad – According to IRS, this tax deduction for contributions can be enjoyed even if you don’t itemize your deductions. This is the one tax advantage we can say is fair and free for all that has access to it.

Pin to Pinterest

Your employer can contribute to your HSA

Employers may choose to contribute to your HSA account. Otherwise, known as a “matching” contribution. Who doesn’t like free money? The IRS sets annual limits on the amounts that may be contributed to the HSA. If an HSA is funded by contributions from both you and your employer, just make sure that your total contribution is within the IRS limit. This is important because, if both your contribution and employer contribution exceeds the annual IRS limit, you might be taxed on the excess.

Tax free interest accumulation

If you invest your HSA money, the interest and earnings from that investment is totally tax free. For me, this is music to my ear. While the amount we can hide in this account is not as much as your 401k, every dollar counts especially, if you are a high income earner.

Tax free distributions

When the time comes, and you want to withdraw the money from the account, the withdrawal is also tax free. This is what we call the triple tax advantage. Of course, the catch is, that you can only use for certain qualified expenses. Am I saying, that you can escape paying tax totally with the HSA account? Yes. It is time to start an account now or with your next enrollment. Make sure to ask your benefit coordinator about which plans are available to you.

Contribution stay in your account until you use them

Unlike the FSA accounts, HSA allow you to keep the money in the account until your ripe old age, which it accrue tax free interest until you are ready to use them. Most likely or hopefully, at a ripe old age.

HSA is portable

We all love portable things nowadays. We have portable computers, portable scanners, and even portable treadmills. Now you can add the Archer MSA to the list. This plan can go with you when you leave your employers. Unlike the disability insurance that is provided at work which ends when you leave. This is also the major difference in the HSA vs. FSA

HSA contribution rules and eligibility.

The recurring theme we would be seeing here is high deductible health plan. To qualify, for this plan, you need to opt for the high deductible health care plan (HDHP). I will quickly catch you up on the plan if you are not aware. For others, please skip to the next segment.

What is HDHP?

An HDHP is a high deductible health plan which has a higher annual deductible than the regular health plans. This plan has a maximum limit on the total annual deductible and out of pocket expenses you must pay for your medical cost.

To be eligible individual and qualify for an HSA, thou shall meet these 5 requirements.

- As described above, you need to be covered under a high deductible health plan (HDHP), on the first day of the month.

- You have no other health coverage. There are few exemption to this, you can check out the IRS site.

- The individual cannot be enrolled in Medicare. This is almost the same as having no other coverage.

- You can’t be claimed as a dependent on someone else’s last year tax return.

- You can’t claim a deduction for an HSA contribution if there is possibility of someone claiming you as an exemption on their tax return. Interestingly, even if that person did not claim you, you still won’t be able to qualify.

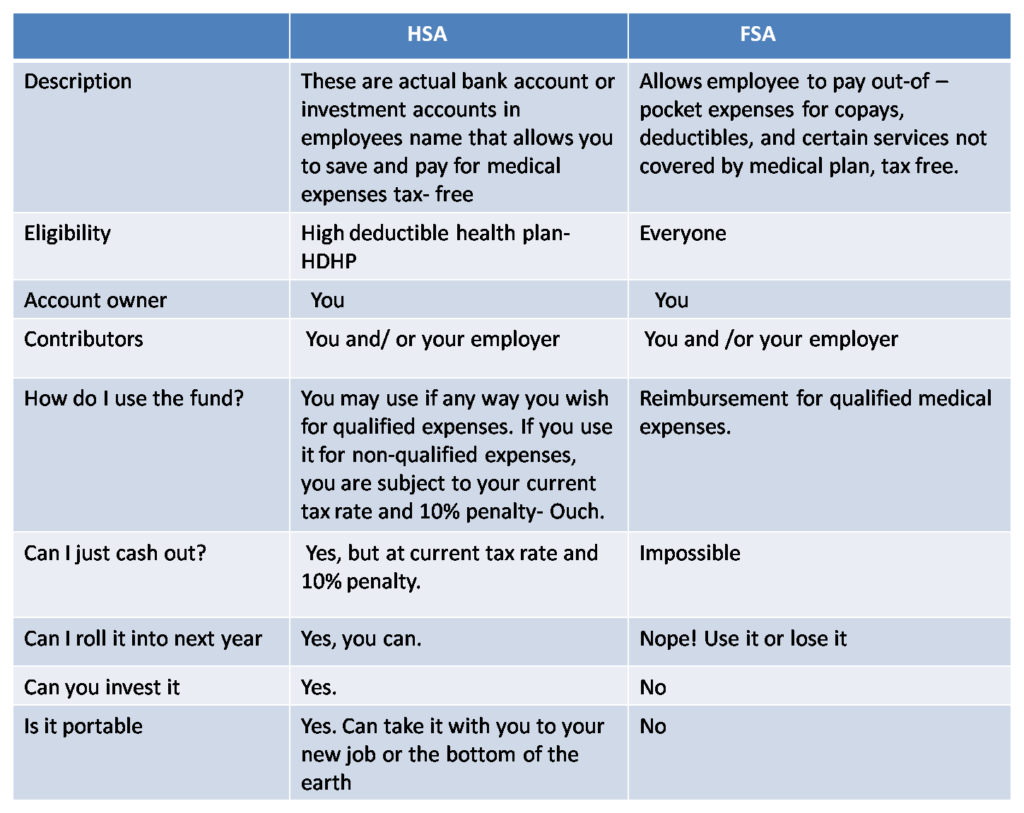

Because there is a lot of overlap between the two accounts, I will go through the FSA account as a contrast to the HSA. At the end, I will be inserting a table to compare the two and decide which one is right for you. Or both.

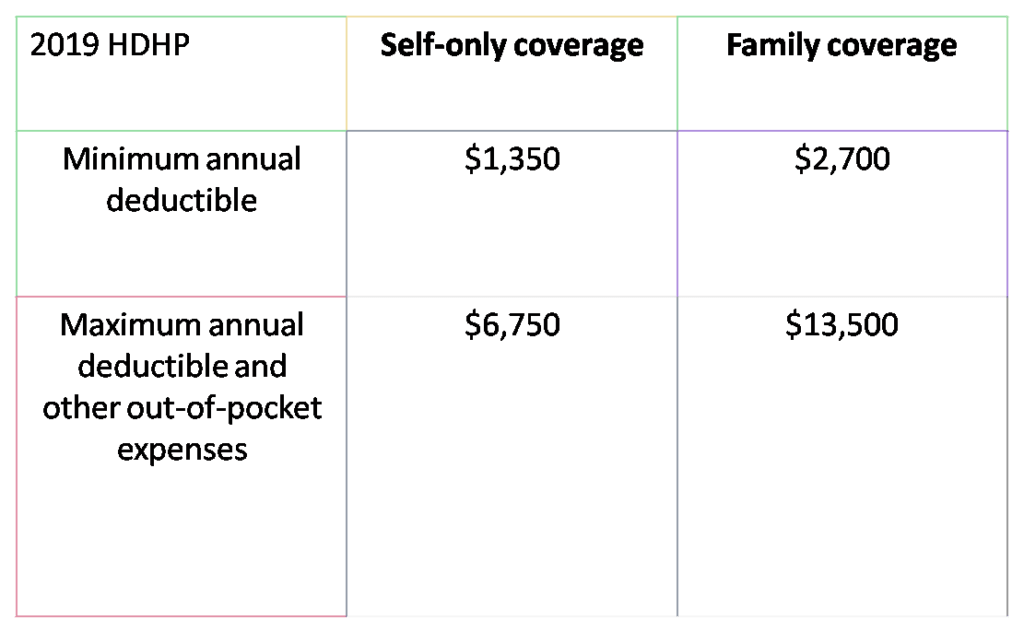

What is the high deductible plan limit

HSA deductible plan 2019

For 2019, a “high deductible health plan” according to IRS is a health plan with an annual deductible that is not less than $1,350 for self-only coverage or

$2,700 for family coverage, and

The annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $6,750 for self-only coverage or $13,500 for family coverage.

The annual tax deduction possible for HSA in 2019

This was as determined under Section 223 of the Internal Revenue Code and has been inflation adjusted as it should be.

Individual with HDHP – Limit is $3,500.

Family coverage with HDHP – Limit is $7,000,

What is a flexible savings account (FSA)?

A flexible spending account is an account (tax-deferred) that is created by the employer to help employees meet medical expenses that are not covered by the insurance plan.

A flexible saving account allows employees to reduce their taxable income which means they take home a larger paycheck.

Benefits of flexible savings account

Many of the benefits are similar to the HSA. The key benefit of the flexible savings account is that funds are contributed to the account by the employee from earnings before being made subject to payroll taxes.

Funds in FSA can be used to pay for over counter drugs, prescription medications.

Constraints of the flexible savings account;

The flexible saving has yearly savings limit; this means there are limit to the amount that can be contributed yearly.

The funds in the flexible saving can be used to cover co-payments and deductibles for medical services. Money in the flexible savings account may not be used for paying insurance premiums.

The money in the Flexible savings account must be used before the year runs out. This is the Achilles heel of this plan.

HSA VS FSA showdown

What are qualified medical expenses

This was listed in detail on the IRS website.

Quick Summary

HEALTH SAVINGS

- Health savings account can be opened by an employer or individual in conjunction with an HSA- qualified high deductible health plan.

- HSA, the contributions can only be made when the owner of accounts is covered by an HDHP.

- Employee’s payroll deduction can be used to fund the health savings account.

- Individual savings can also be used to fund the account.

- The maximum HSA contribution is $3,500 per person with individual HDHP coverage in 2019.

- The maximum HSA contribution is $7000 for people with family HDHP coverage in 2019.

- HSA is portable. An employee goes with the HSA established with the employer after the employee quits or terminates the contract.

- Any money in the HSA that is not used for medical expenses lives in the account

- HSA can also be used for qualified medical expenses.

- Money is never taxed when withdrawn for qualified medical expenses

FLEXIBLE SAVINGS

- Flexible saving account is established by the employer

- The flexible accounts are usually funded by pre-tax payroll and sometimes contributions from employers are also accepted

- Funds from the flexible savings account can be used to cover coinsurance, copays, deductibles and medical expenses that are not covered by the health insurance

- You are eligible to use Flexible savings for OTC medications following the doctor’s prescription.

- Use it or lose it. If the money in the flexible saving account is not used by the end of the year, you lose it. You are only eligible to roll over funds till March the next year

- The contribution limit for a flexible saving account is $2,700 for 2019

- The contributions are deducted from each paycheck all year round. However, the complete annual contribution can be used immediately after making the first contribution.

There you have it. I am sure you already know my favorite based on how much I wrote on one versus the other one. I couldn’t help it. Currently, I do not utilize my work FSA account for health care. I do utilize the dependent care FSA however because, it helps pay for preschool. I use the HSA because of the portability and because we do not require much healthcare as a family.

Please subscribe on the home page and download my free budgeting E-book. This would help you start your financial journey on a solid foundation.

My posts sometimes contain affiliate link. These are companies that we work with. I do get paid a fee if you purchase any of the product. This is at no extra cost to you. Please read more about disclosures here.

Moderate amount of work went into the production of these posts, please subscribe , comment and share.

Thank you

I am a pulmonary and critical care doctor by day and personal finance blogger/debt slaying ninja by night.

After paying off close to $300,000 in student loan debt in less than 6 months into my real job, I started on a mission to help others achieve the same. There is no magic to this than to strap up and get it done. Some of the ways we achieved this include side hustle, budgeting, great negotiation skills, and geographical arbitrage.

When I was growing up, common knowledge in Nigeria is that there is one thing you cannot trust anyone else with, and you guessed it – your money.

Being frugal came easily to me based on my background. However, the concept of building wealth did not solidify in my mind until when I finished medical school. I wish I knew what I know now when I was 14. Still, I don’t know enough and I am constantly learning to improve my knowledge.

My goal is to reduce financial illiteracy among young professionals. I am catering to the beginners – babies and toddlers in financial literacy.

Leave a Reply