Bear market, should we hug the bear or run?

There was a recent scare or should I say hullabaloo about a market crash. People had different reactions. Some were crying and screaming, others developed anxiety. Lots of people on social media have posed the question of how to survive in a bear market. Everywhere you turn, you cannot avoid hearing about the doom and gloom. Don’t even bother turning on your TV if you want to have a good night rest.

This is a common fear. If I had a dollar for every time someone has said the market is crashing in the past 10 years, I would have enough money to live for at least a month.

I am not saying, it is impossible to have a crash, however, this type of event occurs more frequently than you think.

For example, between 1900 and 2013, there were 123 market corrections and 32 bear market periods. The study is old but you get the point.

To better understand this article, let us do a quick catch up for those who do not know what we are talking about.

Table of Contents

Bull and bear market definition

A bear market or when the market is “bearish” is marked by investors being very conservative and pessimistic, resulting in a declining market

A bull market is essentially the opposite of a bear market. In this case, investors are being aggressive and positive, with stock price rising as a result of this optimism.

I consider the BEAR and BULL market to go hand in hand. Think of it as the Yin and Yang of the financial industry.

Before we dig deeper, I found the exercise below to be particularly fun and gets the message across. If you are no fun, please skip to the next section.

Nature teaches us lessons. Here are some of the lessons learned from a grizzly bear encounter in the wild, I have related the encounter to the market.

What to do when you encounter an actual grizzly bear?

Here’s what the experts say:

Do not run.

Meaning, do not leave the market in a BEAR market.

Avoid direct eye contact.

Stop checking your stock every day, save yourself some anxiety and the urge to sell at a loss

Walk away slowly, if the bear is not approaching.

Adjust your asset allocation when the market is good, don’t get too comfortable with high-risk investments.

If the bear charges, stand your ground (you cannot outrun it).

Same as above, DO keep your money in the market, you cannot time the market.

If you have pepper spray, try it if the bear is within 15 feet.

Well, this one is tough, but I will go with, invest more money in the bear market. Get it? Spray the bear.

Don’t scream or yell! Speak in a soft monotone voice and wave your arms to let the animal know you are human.

Remain calm, your screaming or yelling is not going to change the direction of the market. I know it is difficult but try your best.

If the animal makes contact, curl up into a ball on your side, or lie flat on your stomach.

Once you have been hit with a bear market, take the beating like a champ. The only solution now is to wait it out. Just like the cryptocurrency term, HODL – Hold on for dear life.

Try not to panic; remain as quiet as possible until the attack ends.

Again, do not panic. Have a strong and steady hand. Do not sell that stock.

While in bear country, be aware that you may encounter a bear at any time.

The bear market comes with no warning. The so-called forecasters predict the bear market every year.

Be sure the bear has left the area before getting up to seek help.

I will tweak this one a bit. Seek help if you are having trouble with a steady hand. Before you sell that stock, get a financial advisor. This is one of the rare occasions, in which I will support an advisor, if that is what it takes to prevent you from self-destruction. Use the advisor minimally, for a short period of time. Then fire them again!

Pin me. Help me spread to others.

I hope you enjoyed that exercise. Now lets get back to business.

A quick reminder about our bear market definition and easy rule of thumb to remember.

What is a bear market again?

The simple-minded definition says to imagine how the bear fights, it is with the paw down. Hence, the market goes down.

How many percents does the bear kick in?

The quick and dirty version is 20%. Bear markets occur when stock prices drop 20% or more.

The grizzlier the bear, the longer the recovery

There is a study by Guggenheim Investments. Although I am not endorsing their financial services, their study is impressive. Below is a table that describes the findings

The Deeper the Stock Market Decline, the Longer the Recovery

Declines in the S&P 500® (Since 12.31.1945)

| Decline % | Number of Declines | Average Decline % | Average Length of Decline in Months | Average Time to Recover in Months |

| 5-10 | 78 | (6) | 1 | 1 |

| 10-20 | 27 | (13) | 4 | 3 |

| 20-40 | 8 | (27) | 11 | 15 |

| 40+ | 3 | (51) | 22 | 58 |

guggenheiminvestments.com: putting-pullbacks-in-perspective

Bear market versus correction

What is a ‘Correction?’

A correction is a movement, almost always temporary, that accounts for at least a 10 percent adjustment to fix the overvaluation of a stock, bond, commodity or index.

As you can see above, the major difference is the extent to which the market falls.

BEAR > 20%

CORRECTION <10%

Since the start of the bull run in 2009, there have been at least 4 corrections. It then continues back to bull market territory.

Market corrections tend to last less than two months, whereas bear markets last two months or longer.

Ok so, we know what the term means, but have you actually researched it and know the origin of the word “BEAR”? I enjoy knowing the background story of things. I feel like the art has been lost. Our generation just wants quick and dirty versions for most things. Skip this section if you don’t enjoy grizzly stories.

Origin of the bear market terminology

This origin of the word “BEAR” in relation to the market was nailed down to the 18th century in England. Of course, it has to be English.

The leading theory was found in this writing that quotes the following:

“Selling the bear’s skin before one has caught the bear” or alternatively “ don’t sell the bear’s skin before you kill the bear”

Sorry animal lovers. We are not actually killing a bear here. No animal was harmed in the production on this blog post.

The saying above is not foreign to us. It was just worded differently.

In simple terms, don’t count your eggs before they are hatched.

In the 18th century, apparently, there were people who sell what they don’t own in the hope of turning a profit when they finally own it. You might think, so who will fall for that? Well, we don’t put our thinking caps on sometimes when we are promised a huge return.

This act was referred to as “selling the bearskin? And the people being sold the investment were called “bearskin”

Tatler, April 26, 1709

Forasmuch as it is very hard to keep land in repair without ready cash, I do, out of my personal estate, bestow the bear-skin, which I have frequently lent to several societies about this town, to supply their necessities; I say, I give also the said bear-skin as an immediate fund to the said citizens forever.

Another instance was in 1979 by Daniel Defoe’s. The anatomy of change

Those who buy Exchange Alley Bargains are styled buyers of Bear-skin

The bear word was finally solidified in the early market bubble know as the South Sea Bubble.

The south sea company formed in 1711 was granted by Britain a monopoly on all trade to South America and would be given an annual sum of 6% from the government.

As a result, the company’s stock soared and the company was worth an equivalent of today’s 537 billion dollars.

What is interesting is that this company did not start shipping until 1717, that’s 6 years after the company was first formed.

Well, it turned out that the monopoly was worthless as Spain was at war with Britain and Spain held the trade regions at the time. In order words, the stock was a fool’s promise.

Of course, the market crashed as a result.

Read the full story here

For more information on the origin of the bull and bear market, check out the link below

Origin of the stock market bull and bear

What not to do in a bear market

- Time the market

This is an act in which people try to analyze when the market will crash, and quickly remove their money. They then wait for the bottom of the BEAR market and quickly invest at the start of the BULL market.

Isn’t that awesome? Unfortunately, that is just fiction. If you try to do this, you are likely to miss the best days of the market.

We have finally arrived at the guide part.

What to do in the bear market

-

Be a long term investor

Here is everyone’s fear right now. What if I invest my money today and the market crashes tomorrow. Rejoice and be glad! Why?

Because history has shown that a long-term investor can still make money over the long run even if he or she invested at the worst possible time, like the eve of a crash. Provided, that you leave your money in the market.

While I was still quite young to understand the full effect of the 2008 crash, I learned a good lesson from it.

The 2008 Grizzly bear market

This I read from the motley fool and paraphrased it.

The S&P 500 hit an all-time intraday high at $1,576 in late 2007. The bear market came immediately after that and the S&P 500 crashed to a low of $667.

If you had invested on the eve of the crash, which was literally the worst possible timing. You would have been devastated when 58% of your investment got wiped out. People committed suicide as a result of their loss. You would be tempted to take your money out of the market.

With dividends factored in, you’d have around 87% returns or about 6% annualized. On that $10,000 investment, you’d have gained about $8,700.

I am sure some people are sniffing at the 6% annualized return. Well, what was your alternative? Leave your money in cash? CDs? Put it under your pillow or bury it? All the aforementioned tactics would have yielded lower than 6% annually.

Take a few minutes and read about these two references from Motley fool for the full gist.

The 8 Worst Market Crashes of the Last Century

Why You Shouldn’t Fear Bear Markets

-

Have a well-diversified portfolio

We all know the benefits of maintaining a well-diversified portfolio. If you don’t know, then you should know now before it is too late. The reason for diversification is that there is less of a chance for your investments to be wiped out in a bear market if you are well diversified.

Have non-correlated assets and use common sense.

The easiest way to explain this is, do not own only 20 energy stocks or only have stocks in technology. This rule still applies even if that particular industry is booming at the moment. If one sector falls, almost every company except a few survives.

This is what I am working on the most. Do not only invest in stocks but also have some bonds, sprinkle some real estate. Diversify!

Passive income MD wrote a nice piece on diversification. Here is the link below.

Diversification – Back to Basics

I also wrote an extensive article on the 3 fund portfolio which is simple, yet diversified.

-

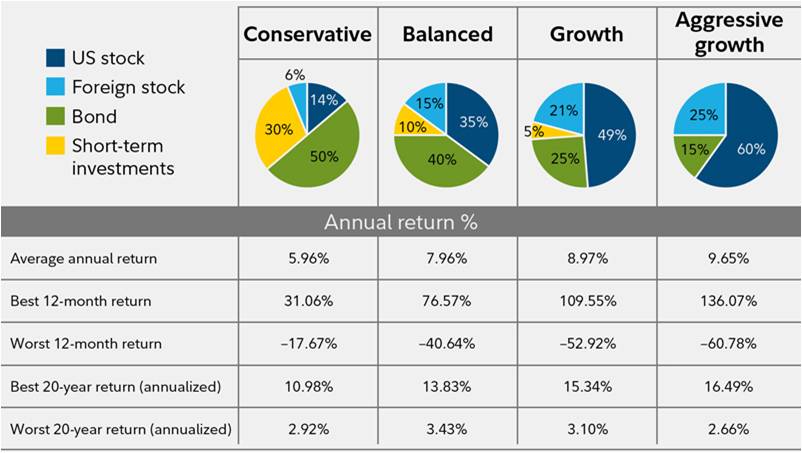

Choose the risk you are comfortable with

You need to define your goals and time frame, and then invest based on your risk tolerance.

When investing, there is no reward without any risk. If someone promises you an investment with a good return and no risk. Run! There is no need to do any research. It is a scam.

Choose what risk you are comfortable with. When you are aware of your risks, you are less likely to panic during a BEAR market. You might still cry, but less likely to pull your money out of the market.

Here is a nice graph from Morningstar

Data source: Morningstar Inc., 2018 (1926–2017). Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. This chart is for illustrative purposes only and does not represent the actual or implied performance of any investment option. See footnote 2 below for detailed information.

My portfolio consists of only 10% bonds because I am a daredevil. That is what I am comfortable with based on my age and other factors. Find out yours and invest accordingly.

Important point: If you’re in retirement, only the portion of your money that you won’t need for another ten years should be in stocks.

-

Increase your position in a BEAR market

For the brave of heart, the bear market is actually an opportunity to buy. I have a blog post I feel too evil to publish titled “ should I pray for the market to crash?”

It is a selfish thing to wish, however, it is an opportunity to go stock shopping. Guess what? Everything is on sale!

Well, apparently no internal link according to Yoast SEO. I love to have a green light always. Blame my OCD. So here are some vaguely related posts. They teach about investment principles.

12 toddler steps to financial freedom

Pretax vs after tax which one is better?

How to become a Roth IRA millionaire

Stock vs Bond, not really a debate

Phew, there you go. That’s all I got for now. Did you learn anything from the grizzly encounter?

Please pin my Pinterest pictures, I really put some work into it, I am a scientist, not artsy at all.

Please subscribe. This is the way to let me know you love my posts.

Any addition to this article is welcomed if you are so inclined. I will give you credit for your work.

I am a pulmonary and critical care doctor by day and personal finance blogger/debt slaying ninja by night.

After paying off close to $300,000 in student loan debt in less than 6 months into my real job, I started on a mission to help others achieve the same. There is no magic to this than to strap up and get it done. Some of the ways we achieved this include side hustle, budgeting, great negotiation skills, and geographical arbitrage.

When I was growing up, common knowledge in Nigeria is that there is one thing you cannot trust anyone else with, and you guessed it – your money.

Being frugal came easily to me based on my background. However, the concept of building wealth did not solidify in my mind until when I finished medical school. I wish I knew what I know now when I was 14. Still, I don’t know enough and I am constantly learning to improve my knowledge.

My goal is to reduce financial illiteracy among young professionals. I am catering to the beginners – babies and toddlers in financial literacy.

xrayvsn says

Love the tie in with the real animal, kudos. Depending on what financial stage you are in bears can be a huge boon (early on in investing career is the best time to hope for a bear market where buy everything on sale) or a curse (worse time for bear market would be right before or right after you pull the plug to retire (sequence of return risk).

There are ways to less those SORR factors such as diversification and some interesting investment strategies that Gasem did a guest post on my blog (Lifeboat policy, SORR are two such posts he made that are great to help combat a bad timed bear)

admin says

Hahahaha, the idea came randomly when i was searching for “how to survive a bear market”. Believe it or not, in the top 10 results, what to do when you encounter a bear popped up. Then, who am I not to take advantage of the situation. I am early in the game, so it is selfish of me to wish for a bear market. But in my darkest thoughts, the thought cross my mind. You always have awesome posts for everything on your site don’t you. Learning a lot from you and I will finally consume your site after my critical care board exam. I am sure, it will also spark my post ideas. Thanks for stopping by.

Teri says

You are such a comical funny person. I enjoyed the read. Thanks for the tips on the difference between bear and bull. I always forget and the imagery is gonna be very useful for me. I am super new to stock market and I bought a few on Robinhood App a few months ago. I am glad you confirmed some of my….Noob…ideas. I was thinking to just stop checking them all the time and think long term. It’s so hard when the stock keeps falling! But I have stuck it out so far. Hoping for that 5 year return! I hope I am not naive. I also was looking at buying more since so many companies are low right now. So you seem to have similar ideas as what I was thinking. So maybe I am not wayyyy off.

Teri – http://millennialadulting.life

admin says

Thanks for the compliments. My thoughts on Robinhood app. This is an awesome platform for short term trading. I played around on it for some time but I stopped. Main reason is that I don’t like investing in individual stocks nor is it advisable on the long run. You can use play money to dabble, which is 5% of your networth. If you want to build wealth, my personal choice is low cost index funds. I am not sure which country you are from, but if you are in USA, Vanguard is what I use.

in terms of the investment already in Robinhoob, try to keep them for a year to avoid short term capital gain and then take your money out and invest for the long term in index fund.

Of course, this is just my thought, what I would do. Not financial advice

Dale_TheMoneyGuy says

I love the comparison. This year has been gut check time for a lot of people. I even find myself going against some of my own advice and my emotional instincts tell me to do something stupid. Thankfully I don’t listen too closely to that.

admin says

Thanks for stopping by Dale. It is tough to stay on track. And its easy for us to all write it and talk about it, but when it comes time to implement, everyone face the same problem. It is not easy. I am glad you stuck to the plan. Its always better to separate emotion from investing if possible.

Amanda | Spending to Save says

I looked at my retirement account a week or two ago and was dismayed at its negative return for the quarter. I know I just need to ride it out so I’m limiting myself to how many times I can check it out every quarter.

admin says

We all get tempted to check and that could lead to some irrational decision. My personal capital sends me messages every once in a while that my portfolio is down by a certain percentage. Stay the course. Especially if you have long horizon. Like 20 years or more to invest.

Ryan says

Solid post my friend! I love the bear analogy. The visuals incorporated into the market were soot on. Keep up the great work!

admin says

Thanks bro. I figured, why not include some funny stuff sometimes. I am glad you love it! Thanks for stopping by. Really appreciated.