Did you know that some of the wealthiest people credit their success in large part to budgeting their money properly? Who would have thought, that a trick so simple as budgeting your money on a regular basis could mean the difference between millionaire and bankruptcy?

We talk a lot about budgeting and getting out of debt on this site because we know these are the most fundamental things to get started on a good financial foundation.

The fact is, regardless of your current financial situation, you need to budget your money, or your money will take over and drive you in the wrong direction.

Here is the complete guide to how to budget your money, and a list of top tips and tricks from financial professionals that will make or break your financial health.

Before you dig deep, you can check out our philosophy about finance in our post on Dave Ramsey is outdated, try our 12 toddler steps to financial freedom instead.

Budgeting is boring, but it is necessary to reach financial independence. No need to worry, we will walk you through how to budget your money to live the life you want.

First, we discuss 10 reasons to budget, 8 steps to create a successful budget, 5 risks of not managing your money, 4 tools to manage your money including our free budget template, and to cap it off, we discuss the money habits of millionaires from reputable sources.

Also, join the Breathe Easy team. We will send you our budgeting and finance E-book which is free for a limited time.

Tips & Tricks to Manage Your Money Like A Pro

Upon researching some of the most reputable money management experts, top blogs on money, and some firsthand personal experience, we’ve put together a guide on getting started with your budget and money management properly. Follow these tips and tricks, and your financial future will be abundant, to say the least.

Why you need a budget

Before we discuss how to manage your money properly, it’s wise to understand the why behind the what. Here are 10 reasons why you need to keep a budget. Remember these “why’s” and your motivation will always be alive and strong.

1. It ensures your financial future

Think of a budget like a treasure map. Your goal is to find the buried treasure, and you need to know how to find the “X” where the treasure is buried. “X marks the spot!” Your budget is your map to the buried treasure, and the buried treasure is where you want to be at different stages in life financially.

Without a proper plan to get to your desired destination financially, chances of you arriving at your destination are slim to none.

A proper budget that is followed regularly and religiously will guarantee you are in full control of your financial future.

We talked about 5 simple budgeting steps for young adults to arrest their debts and that article is the easiest way to start without getting intimidated.

2. It keeps you away from bad debt

I’m willing to bet that many of you reading this may have been, or currently are in deep debt looking to get out. Perhaps the majority of consumers financial stress lies in the amount of debt they have, and how they are ever going to get out of debt.

With a proper budget, you stay away from debt and steer yourself out of debt. With the proper steps to get out of debt, and stay out of debt, you will witness first hand that building your wealth soon becomes easy.

We actually have a series called “get out of debt series” where we interview people who have had a debt encounter and survived by slaying their debts.

These nice guests spill the beans on how they did it. Those articles are very inspiring, you definitely want to bookmark it and check them out.

3. It prepares you for unexpected events

Ever had an unexpected event like a flat tire, or a hospital visit (heaven forbid)? More often than not, when these events happen, consumers hadn’t planned properly to pay for the unexpected. So, what do they do? They put it on their credit card or take out a loan to pay for it.

The net result is a decrease in net worth and a BIG step backward financially. With a proper budget, you will have established a healthy emergency fund that is used only for unexpected emergencies.

This keeps you away from bad debt and even lightens the stress if and when the unexpected happens because the financial stress is eliminated from the already stressful situation.

We have an epic post on emergency fund in our financial pyramid post. The post itself talks about how to set your finances on a solid foundation. It established emergency fund as one of the most important foundations to your financial pyramid. This prevents you from dipping into credit cards.

Also, here is how to save your first $1,000 dollar emergency fund so fast that you will be amazed.

4. It prepares you for a happy retirement

It’s been said that retirement isn’t necessarily an age, its more so a number. And that number is the amount you have saved up for retirement. That number needs to be enough to replace your income from your job for the rest of your life. If you don’t plan properly, you will be working for the rest of your life.

By simply deciding how much you want to live on annually when you retire, you can project how much you will need to be able to retire. Once you have determined that, you can decide how much you need to save to ensure you are on track financially to retire, and how long it will take you to get there.

Managing your money properly with a well-written budget, your retirement will be planned for, so you ensure you aren’t working forever. Not only that, you will actually be able to enjoy your retirement knowing you’ve set a plan that will ensure you always have a monthly paycheck to live on.

For how to save for retirement, check our articles related to retirements. For example, the article on all you need to know about 401k retirement plan walks you through all the nook and crannies of 401k.

PIN THIS IMAGE TO SHOW YOU LOVE OUR CONTENT

5. It enables you to live comfortably

Without a budget, your money will run out quicker than the month, guaranteed. With a budget you can be sure that this doesn’t happen, and that the month runs out quicker than your money does. If that makes sense.

Managing your money properly allows you to live and do the things you enjoy, knowing you’ve planned financially for them. There is no guilt in spending money because you’ve planned for it. And there is no stress in having enough money to live on because it has been properly managed and budgeted.

If you want to check out Mrs. Breathe Easy’s tips on budgeting tips, that would get you started. This has allowed us to live more comfortably.

6. It allows you to take vacations

Vacations aren’t only fun, but they are also a healthy habit to get into. The problem lies in people not planning for a vacation, and thus they aren’t ever able to take a vacation. With a budget, you can take a vacation to your favorite place on earth with just a little planning and preparation.

Budgeting allows this to become a reality and enables you to reap the benefits of a fun vacation AND a healthy stress level. Vacations lower stress levels and allow you to enjoy life the way it should be.

We as a family budget about $6,000 dollars for vacation a year, for now, it is up to us to use it once or do mini travel locally multiple times. Now that we have got rid of our debt and cash flow has increased, we plan to increase this appropriately in the future.

7. It saves you from spending money you don’t have

Perhaps you decide to go “window shopping” with your friends. But when you made that decision, you didn’t know that your favorite store in the world is having their annual sale. You have to spend money and take advantage of the great deals, right?

I’m sure you can relate to some extent. It’s not uncommon to be out and about with your friends or family, and you end up making an impulse purchase with money that you don’t have. The result? More debt and a guarantee that you will be working forever if you don’t turn things around.

By following the proper process to budgeting your money, you eliminate spending money you don’t have and can spend money without guilt. You have properly prepared for events like this and thankfully will have set aside some spending or “fun” money to buy things when out having fun.

This post, which I describe as a buffet of money saving tips showcase 101 ways to save money that you wish you knew. This is an epic post of over 8,000 words with a lot of research and work that went into it. That’s a post to bookmark for later.

8. It teaches you healthy financial habits

Actions practiced repeatedly soon become habits. And a habit is a decision that is made so often that you no longer need to think about making the decision, you just naturally do it. Healthy financial habits in a way put your finances on autopilot.

You’ve been practicing these money management tips for long enough, that they become natural and easy to follow. In fact, it can even result in making it more difficult to go against your developed financial habits when you are tempted to spend something not budgeted for.

This is why we wrote an article looking into if everyone needs a budget. Once you have become a pro, you might change to reverse budgeting style in which you invest your money first and then spend the rest. The link was a review of the top financial book – The Richest Man In Babylon. Lots of wisdom in that book. Check out our review and get a copy for yourself.

9. It will be passed on to your kids and grandkids

Speaking of healthy financial habits, should you decide to have a family, you have a big responsibility to raise your kids to achieve their fullest potential. As your kids see your financial habits in action, they will naturally adopt them and pass it on to their kids, and so on.

Creating and keeping a budget regularly not only has its financial benefits, but it has the benefits of allowing you to teach good financial principles to future generations to come!

To be sure you are passing the best financial gene to your children, you might want to know the financial habit of your partner before getting married or at least try to be on the same page after marriage. Our best tips for marriage and finance is in the article about focusing on finance instead of love. You will find it intriguing to read.

10. It opens up new opportunities

After budgeting for some time, it is not uncommon to reach a certain point that you have a strong enough financial situation, that you actually have enough money to spend when you want and on what you want. It’s the law of compound interest, meaning, that interest built upon interest grows exponentially larger over time.

The post on the rule of 72 walks you through when you will double your money. The article is our second most clicked article so far. Couple that with our compound interest calculator, you will know exactly when you will reach your first million. Go ahead and play with our free compound interest calculator.

With a large lump sum of money in the bank, perhaps one day you are presented with an opportunity of a lifetime to take over as the owner of your favorite business in the world.

However, in order for this to happen, you need a lump sum of cash to get started as the new owner.

Had you not been budgeting properly all those years, you would never have been able to take advantage of a once in a lifetime opportunity to own a business you’ve always dreamed of. Managing your money with a proper budget in place opens up the potential for endless opportunities that WILL present themselves throughout your lifetime. I think we can agree that you will want to be in a place to take full advantage of those opportunities.

If you are loving our content so far, please do us a favor and sign up for our free budgeting and finance Ebook.

Steps to creating a successful budget

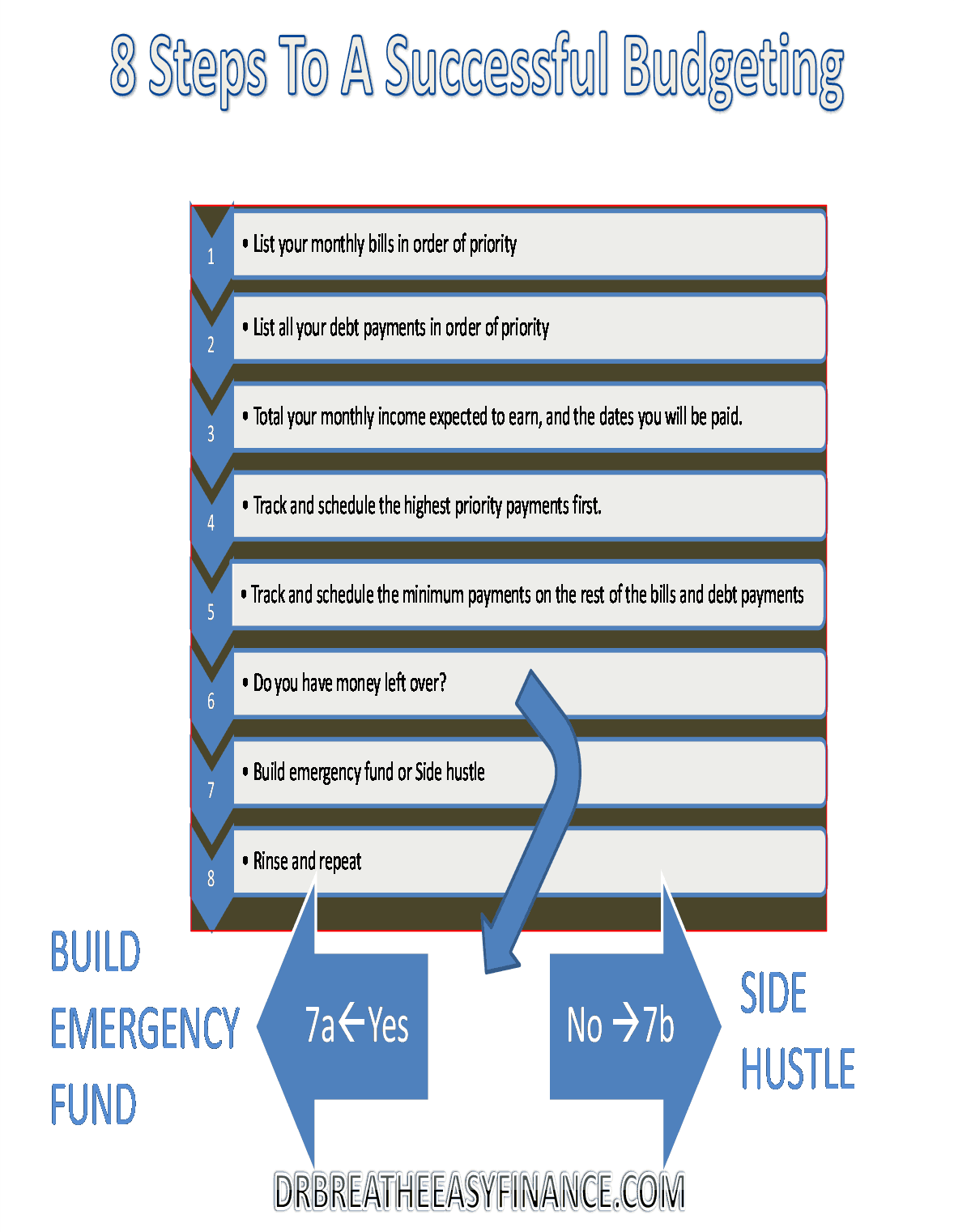

PIN THIS IMAGE

Creating a budget is actually much easier than you may think. In efforts of making the process easier to start, here are a few steps worth noting to create your monthly budget:

- List your monthly bills in order of priority. This is not including debt payments, just bills such as water, gas, rent, etc.

- List all your debt payments in order of priority. Your mortgage or car payment may be a priority over a credit card payment, for example.

- Total your monthly income expected to earn, and the dates on when you will be paid.

- Track and schedule the highest priority payments first. This includes mortgage or rent, food, water, and heating. Subtract this from your monthly income and set it aside to reserve for payments.

- Track and schedule the minimum payments on the rest of the bills and debt payments. Set this money aside to reserve for payments.

- Do you have money left over?

- Yes – Go to step 7a

- No – Go to step 7b

- Discretionary income

- If you don’t have an emergency fund, begin putting your extra money left over into an account for emergencies only. This should be between $500 – $1,000 saved. Once saved $500 – $1,000, this extra money goes towards paying off debt.

- If you don’t have extra money left over, then you need to seek ways to cover any unpaid expenses and save for emergencies. This means getting an extra job in the evenings or doing freelance work on the side. Keep in mind this may only be temporary until you can get above water and you have an established budget and financial health.

- Repeat the above seven steps until they become a regular habit. You should schedule time each week, biweekly or monthly to review and update your budget.

Creating a budget is the first step to a healthy financial future and following the above 8 steps will help you accelerate the process to budgeting properly. The idea is to have a regular process in place that ensures you pay all your bills on time, that you account for every dollar that you spend, and that you plan properly for upcoming events. As your finances evolve, you may alter the budgeting steps above some to fit unique scenarios and priorities for your situation.

Risks of not managing your money

While the benefits of managing your money are nearly unlimited, so are the risks of not managing your money properly. In efforts of building your motivation to manage your money, there is a benefit in knowing what could happen should you fail to use a planned budget.

1. Risk of bankruptcy

Have you ever been in a lot of debt? This could be anything from having debt up to your eyeballs to having a few credit cards near their spending limit. I’m sure that probably includes all of us for the most part. Do you remember how you got in that amount of debt? Didn’t think so.

Debt is a byproduct of not budgeting your money. And the sad part is, once you decide to stop budgeting your money, the debt begins to creep in and before you know it, you’re having discussions about whether to file for bankruptcy or not. Some think this sounds like a way out, but make sure you take a look at all the consequences of a bankruptcy on your record:

- It’s public information for anyone to see

- It is shown on background checks

- It will affect whether you are hired for certain job opportunities

- Banks will not want to work with you

- You won’t be able to get a loan of any kind for a long time. And if you can, the interest rates will be in the hundreds.

- Your self-esteem will be at an all-time low as a byproduct of all the above-listed consequences

Bad money management in time will result in deep debt, and that is not a place you wish to be.

We discussed consolidation and other strategies to consider before filing bankruptcy in the past.

2. Bad reputation and poor credit

A bad credit score is a result of not paying your bills on time. If you don’t manage your money properly, you’ll find yourself running out of money too quickly, and not enough to cover the bills. This results in lower credit score and low trust from financial institutions like banks and credit unions.

In some cases, when your debt due to bad money management gets out of hand, it is common to go to friends or family asking for a quick loan that you promise you will pay back. Those bad money management habits are still there, and your friends and family become another unpaid loan affecting your relationships and reputation.

3. High-stress levels

Money is not everything, as we’ve all heard. But it does have its place in how our lives are run. We can’t have a roof over us, a bed to sleep on, food to eat and warm shelter to stay if we don’t have money to pay for it. And not having access to essentials such as these will no question create stress levels that seem unmanageable.

4. Poor quality of living

With unpaid bills and late rent and mortgage payments, naturally, you seek to spend money on only the cheapest quality of products, because you cannot afford the cost of extra comfort. Ironically, this can also lead to spending lots of money on things of no worth that give you quick satisfaction such as eating out more and spending money on entertainment to cope with financial stress. When taken to extreme levels, in some cases it can lead to illegal activity.

5. Leads to bad life decisions

The high-stress levels of bad financial habits combined with the overall lower quality of living can sadly lead to even worse decisions being made. In extreme cases, this may include things such as illegal activity and even drugs.

The overall downward spiral of poorly managed money can lead to, in extreme cases, a nearly unlimited path of uncomfortable consequences as mentioned above. To cope with these consequences, more bad decisions are made, and the path is an endless spiral.

Awesome budgeting tools that make money management fun

With the use of innovative technology, managing your money now only takes a few minutes per day. In fact, with some popular tools mentioned below, a lot of the mundane tasks to keeping a proper budget are actually automated. These tools are user-friendly to use and give you a better perspective on your financial future.

The first tool is to have a budget template. This is the one we use personally. All you need to do is insert the cost for everything you spend money on. This template did a good job in listing most things.

You might not find something like super specific like chicken soup recipes. Kindly add that under groceries.

1. We present the free budget template that we use personally

Personal Capital – Personal Capital is a budgeting tool that nearly automates the entire budgeting process. It will break down all your money going into and out of your bank accounts. It can project what your current savings habits will result in the future and even allows you to project different financial scenarios.

It works by syncing to your banking and investment accounts aggregating all the data into one central location. It then organizes your spending, savings, and investments so you can see how much of each area you have total.

It will even show you areas where you can improve and make know of potential hidden fees you didn’t know about from outside services and subscriptions you use.

We use the personal capital free version to budget and also track our investment and networth. At this time, we have no affiliation with the company, we recommend it because it is awesome. simple as that.

YNAB – YNAB stands for “You Need A Budget.” It’s a modern budgeting tool for hands-on consumers. Its budgeting concept is taken from living on last month’s income to accurately project your income and budget for the current month.

YNAB has multiple similar tools to Personal Capital, allowing you to view your accounts and budget plan in one location to easily manage your money.

Prism – Prism is an app that allows you to track and manage all your bills in one location. With the Prism app, you can make payments, keep track of upcoming bills, and schedule payments to be made at a future date.

The goal of the Prism app is to make paying bills easier and hassle-free so you can ensure you are all caught up on your monthly expenses.

Budgeting Tips & Money Management Advice from millionaires

Upon studying the habits of millionaires across the world, companies like The Balance and Every Dollar have shown eye-opening stats that show you that the path to wealth is much easier than it may seem.

The following tips from millionaires were the result of studying thousands of millionaires and their regular spending habits. Every Dollar is a popular budgeting app created by the well-known financial expert Dave Ramsey. Here are few millionaire tips taught by Every Dollar. These are the surprising money habits of millionaires

- They set goals

- They use coupons

- They avoid debt (check out our post on how debt is bondage and how to set yourself free)

- THEY BUDGET THEIR MONEY

Furthermore, The Balance as said above is another popular website with advice on money management and money-related topics. Here are a few millionaire tips taught by TheBalance.com: One thing most millionaires have in common.

- Live frugally

- Drive used cars

- Buy used cars

- “They budget and track every penny”

The last bullet point in each of the tips above should give you an idea of the importance of money management, and why learning how to budget your money is so important.

Imagine your future…

It’s been said that compound interest is the 8th wonder of the world. Why? Because interest build upon interest has miraculous effects, in the long run, resulting in exponential growth of your money. The same principle applies to paying off debt, sticking to a budget, and investing your money regularly.

Check on this post on time value of money. Is it better to take 10 grand now or 1 million in the future?

Imagine how healthy your finances will be, or how much wealth you will have obtained by implementing the simple habit of budgeting your money on a regular basis. A rock that lies at the bottom of a stream starts out as a jagged-edged rock, but over the years and decades of time, it is smoothed out to a well-rounded stone. The same principle and results apply to healthy financial habits and proper money management.

Before you go, for full disclosure, if you would like to know the weaknesses of budgeting also, check the limitations to budgeting and how to fix them.

That’s another epic post right there. Take 5 seconds and get your free budgeting template. Yes! Freebies!

Pin our image.

Use the share button and don’t forget to comment and let us know what you think. Can you find holes in our argument? And do you have other tips to add for our audience? Let us know.

I am a pulmonary and critical care doctor by day and personal finance blogger/debt slaying ninja by night.

After paying off close to $300,000 in student loan debt in less than 6 months into my real job, I started on a mission to help others achieve the same. There is no magic to this than to strap up and get it done. Some of the ways we achieved this include side hustle, budgeting, great negotiation skills, and geographical arbitrage.

When I was growing up, common knowledge in Nigeria is that there is one thing you cannot trust anyone else with, and you guessed it – your money.

Being frugal came easily to me based on my background. However, the concept of building wealth did not solidify in my mind until when I finished medical school. I wish I knew what I know now when I was 14. Still, I don’t know enough and I am constantly learning to improve my knowledge.

My goal is to reduce financial illiteracy among young professionals. I am catering to the beginners – babies and toddlers in financial literacy.

Meagan says

Budgeting is pretty much the make or break for our finances! We’ll be barely scraping by, then get back on track with budgeting and watching where our money goes and it’s like we suddenly have all this extra money! Didn’t get a raise, just actually stopped flushing it down the toilet.

Amanda | Pinwheels and Piggybanks says

I’ve been resistant to creating a budget because it seems like so much work and I think I have a pretty good sense of where my money goes, but the advantages you argue certainly seem to be worth a bit of time and effort. Now I would just need to get my husband on board!