By Joseph Sheeley, a.k.a. SmallIvy

This is another awesome Guest about cash flow plan which is better than budgeting. This gentleman is highly motivated and honestly, the content he produces is what I call epic content. It is also an honor to have an author on my blog. I made sure to grab the free copy of his latest book (FIREd by Fifty) on Amazon before the offer ended. Thanks for that.

Please read our disclosure page for affiliate disclosures

Who is SmallIvy

Joseph Sheeley, a.k.a. SmallIvy, is a personal investor who reached financial independence at the age of 42 and is passionate about helping others reach financial independence too. Still working as a rocket scientist by day (because it’s so much fun), he runs The Small Investor blog and is the author of The SmallIvy Book of Investing, Book 1: Investing to Grow Wealthy and FIREd by Fifty. He has been a personal investor for more than 35 years.

Note, kindle version of the book of investing is free at the time of this writing, click the link above to see if the deal is still available

Creating a budget is an important first step in getting financially fit. While you may be thinking that living on a budget is limiting, you’ll probably find that you actually feel richer if you create and stick to a budget.

This is because using a budget allows you to control where your money is going. You spend less on things you really don’t care about and soon forget, leaving you with more money to put toward things you do care about.

You don’t go to Walmart and go home with a load of crap that clutters up your house, so you now have more money to put towards things like hobbies and travel.

With a budget, you typically start by listing your income, including your salaries, money from side-hustles, and any passive income you’re receiving from things like bank accounts, book royalties, or rental apartments at the top of a sheet of paper or spreadsheet.

You then start to spend all of that income on paper, listing your expenses below your income.

A good budget will include some money for saving and investing(click for beginner tips on how to invest), perhaps listing saving and investing first if you choose to “pay yourself first” as many people advise.

Every dollar should find a home since leaving anything off just leaves room for abuse and waste.

Once you have a budget, you then need to stick to it or you have wasted your time. If you have $200 per month budgeted for eating out, once you’ve spent $200, you need to stay in for the rest of the month.

Many people use cash systems(modified Dave Ramsey cash envelope system), taking out cash at the start of the week or month, then allocating cash to each category as dictated by the budget at the start of each budgeting period, to help them follow their budget.

Most people also find that spending cash mentally hurts more than spending credit, so they tend to spend less when they use cash.

If you don’t believe me, try paying with $20’s when you go to the supermarket instead of pulling out the credit or debit card.

You’ll probably find that you’re more careful in making your decisions and be less likely to throw a few extra items in the cart.

Sometimes you do miss something when you make a budget or something important comes up after you’ve made a budget.

If that is the case, you need to go back to your budget, with your significant other if appropriate, and change the budget.

This forces you to figure out where the money will come from rather than allowing yourself to blow your budget.

Related post – Limitations to budgeting and how to make it work for you

Take few seconds and pin this image

Cash flow plan – Budgeting on steroid

Table of Contents

Going beyond a budget

Budgets are great, but they are like a photograph. They cover one static period of time. So long as everything balances, a budget will tell you that things are just fine.

But what if there are expenses coming up next month or next year, looming like an iceberg under the waves, ready to wreck your fiscal ship?

Also, you know that you’re saving and investing from your budget, but how much do you need to be saving to meet future goals?

Are you investing enough to become financially independent in ten or twenty years?

A budget won’t tell you these things because it is static, just like how a photograph will not tell you what happened before or after the photo was taken. For that, you need a more powerful tool.

A cash flow plan is like a budget on steroids. It includes all of the information that you have in a budget, but also includes data on where your money is going and where you will be in the future.

It lets you see how much you’re putting towards important things in your life and how much you’re wasting. It also helps you plan for future expenses, like that new roof or car that will be needed in a few years.

A cash flow plan also reveals the secret to gaining financial independence. It shows that if you have a cash flow like most people, where every dollar that comes in gets spent, your net worth will remain fixed.

On the other hand, however, if you have a cash flow plan where money is being directed into investing, that investment will increase your income.

If you then direct that investment income into still more investing, the feedback loop you create causes your net worth to grow exponentially.

A cash flow plan begins with a budget

To create a cash flow plan, start with a yearly budget. On a piece of paper, list all of your expected income for the year, then list all of the money you’re going to put towards savings, investing and expenses.

Continue to add and adjust things until everything is covered. If you find that things don’t balance, you’ll need to adjust your spending to make sure that your budget is sustainable or bankruptcy will be in your future.

Once you have a budget on paper, you’ll probably want to switch to a spreadsheet for the next step.

While you can keep a cash flow plan on paper, it is much easier to adjust things as time passes if you use a spreadsheet program with linked cells.

To make things simple, there are instructions on how to get a free spreadsheet with a linked budget and cash flow plan in the book, Fired by Fifty.

You can also create your own with minimal knowledge of spreadsheet programs. If you do want to just keep a cash flow plan on paper, you’ll probably want to use separate pages for each of the “boxes” that follow in the description since that will allow you to replace the pages as needed when you update the plan rather than needing to write everything down again.

From budget to cash flow plan

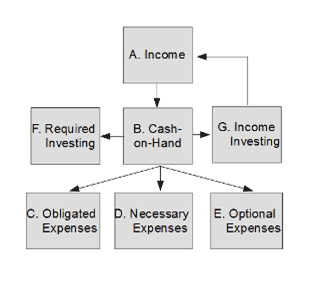

In creating a cash flow plan, we’ll take the budget you have and divide up the information into separate boxes with money flowing from box-to-box.

In doing so, a cash flow diagram will be created that shows this flow. The structure of the cash flow diagram is as shown in the figure below.

Structure of the cash flow plan

You’ll note that money starts at the top as income, flows into a box called Cash-on-Hand, and then flows out into different types of investing and expenses.

Expenses are broken down into Obligated Expenses, Necessary Expenses, and Optional Expenses. Investing is separated into Required Investing and Income Investing.

Let’s look at each of these boxes as we build the cash flow plan.

Box A: Income: Income is obviously just what it says – money coming into your life. To fill this box, take your budget and rewrite your income portion, grouping your income items together into larger categories like Salaries, Bank Interest, and so on. As time passes, hopefully more and more of your income will be coming from your investment.

Box B: Cash-On-Hand: This is the money that you have in your bank account, in your wallet, or under your mattress. In a cash flow plan, you have both the amount you have now and the amount you expect to have at the end of the year due to income and expenses. If your income exceeds your expenses and you don’t invest it, your Cash-on-Hand obviously goes up. If expenses and investments exceed income, Cash-on-Hand decreases.

Box C: Obligated Expenses: Obligated expenses are things that you’ve signed up for like a mortgage or car payments. These are fixed unless you pay off the loan fully since you can’t pay part of a mortgage payment.

Box D: Necessary Expenses: These are expenses that you need to pay to live, but can generally cut in size if needed. Things like food, clothing, and shelter fall into this box.

Box E: Optional Expenses: These are luxuries, which are things you really don’t need and could cut entirely if required. They are also the things that bring joy into life, however, so at least some of your money should find its way here.

Box F: Required Investing: Required investing includes investments for things like retirement and college. Note that you place these right in the cash flow plan so that you don’t miss them as you might in a budget.

Box G: Income Investing: These are investments outside of retirement and education funds that generate income for you. This box also includes funds you’re saving up for things like new cars and vacations since they can be invested until the money will be needed soon. Retirement accounts and other accounts in your Required Investing box shift to Box G and also become income investments once you reach the age/point where the accounts start to be used for their intended purposes.

This gives a brief overview of the boxes. To see an example of a cash flow diagram with the boxes filled-in with some broad categories of items, see the article, Setting Up a Cash Flow Diagram to Grow Wealthy.

Positive Feedback

Note that there is an arrow going from Box G to Box A. This represents the extra income that is generated by your income investments, either directly as interest and dividends or through capital gains.

This is the most important feature of the cash flow diagram when it comes to your quest for financial independence. It shows you how much potential extra income your income investments can be generating for you during an average year.

If you can set yourself up to have a positive feedback loop, where the extra income you are generating is used to buy more assets, which in turn generate more extra income, you will see your passive income grow and grow to the point where it exceeds income from salaries. At that point, you would have reached financial independence.

Check out the compound interest calculator to calculate how much you would have in 30 years using the reinvest the interest method.

To estimate the amount of the extra income going back to Box A from investments on any given year, take the average rate of return that sort of asset would create.

For example, if you’re invested in stock mutual funds, you might choose a number like 10% of your mutual fund portfolio value each year.

For bonds, you might pick 4-6%, depending on the kinds of returns you are getting at the time.

Note that your returns from these investments will actually vary from year-to-year, with some years actually providing negative returns, but using estimated values allows you to adjust your spending to ensure that, on average, you’ll be putting enough cash away into investments to reach your goals for financial independence.

You just need to be careful and make sure that your reinvestment rate, the amount of cash that is flowing from Box B into Box G, is at least 50% of the predicted income being generated, the amount flowing from Box G to Box A, so that most years you’ll not be spending more than you’re making.

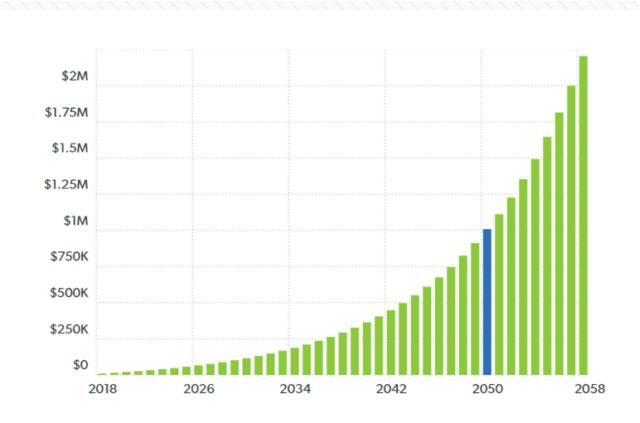

Growth of an income investing account at a 10% return with a $300 monthly free cash flow

Free Cash Flow – An Important Number

The amount of money you have flowing from Cash-on-Hand, Box B, to Income Investing, Box G, is called your free cash flow.

This is how much money you have available to save and invest after you have paid for everything and put aside money for things like college and retirement.

This number also gives you an idea of when you will be able to reach financial independence. To determine this, do the following:

- Find your non-work yearly expenses, which is the amount of money you spend each year on things not related to work. This is how much money you need your income investments to generate each year To find your non-work yearly expenses, just add the totals going into your expenses boxes and subtract off things like extra gasoline and clothing you won’t need when you’re not working.

- Multiply your non-work yearly expenses by fifteen. This is how much money you’ll need to carry you through until you reach retirement age and can start to access your retirement accounts assuming that you’re retiring in your 40s. If you’re planning to retire in your thirties, multiply by twenty. If you’ll be in your fifties, multiply by ten. (Note that you still want to be saving for retirement while you’re saving for financial independence even if you plan to retire early so that you’ll get a second kick of cash to help get you through retirement.)

- Go to an investment calculator online such as this one by Dave Ramsey, plug in the balance of your current age, income investments at this point, and your free cash flow divided by 12 as your monthly investment. Plug in a value for an expected interest rate based on your investment style. For example, if you’re investing 100% in stocks, use 10%. If you’re investing 50% in stocks and 50% in bonds, use 7%.

- Look at the predictions for your yearly balances that the calculator produces. An example where I put in $10,000 as the current balance and $300 per month in free cash flow is shown in the figure.

- Pick off the year in which the balance of your income investments will equal or exceed the value you calculated in step 2. This is the year when you’ll be financially independent. For example, if you needed a $1 M portfolio that would occur in the year 2050.

Wow Wow Wow. This is what happens when you ask an author for a guest post. You get a very detailed analysis.

I have learned a lot from reading this article myself. If you have not grabbed a copy of his books, do yourself a favor and get them. You might still be able to get a free kindle version through my link.

Check out our sponsors to see if any of them can help you out on your financial journey.

If you enjoy the content of this site, please support us and engage. Look around at our other articles. Our highest viewed articles are 12 toddler steps to financial freedom (an upgraded version to Dave Ramsey’s outdated model) and Financial pyramid (which talks about how to build and protect your wealth with ultimate financial planning)

First, grab a copy of your budgeting E-book as a free gift from us on our homepage

Please comment, pin the image and share this post and other posts you find exciting to spread the word.

I am a pulmonary and critical care doctor by day and personal finance blogger/debt slaying ninja by night.

After paying off close to $300,000 in student loan debt in less than 6 months into my real job, I started on a mission to help others achieve the same. There is no magic to this than to strap up and get it done. Some of the ways we achieved this include side hustle, budgeting, great negotiation skills, and geographical arbitrage.

When I was growing up, common knowledge in Nigeria is that there is one thing you cannot trust anyone else with, and you guessed it – your money.

Being frugal came easily to me based on my background. However, the concept of building wealth did not solidify in my mind until when I finished medical school. I wish I knew what I know now when I was 14. Still, I don’t know enough and I am constantly learning to improve my knowledge.

My goal is to reduce financial illiteracy among young professionals. I am catering to the beginners – babies and toddlers in financial literacy.

Melanie says

Interesting analysis! Retiring early isn’t on my radar, but I enjoyed seeing the process behind figuring out how much to save.

smallivy says

Thanks! Even if you don’t want to retire early, just getting a hold of your finances makes life so much less stressful. I have no plans to retire, but still enjoy the peace that financial independence brings.

Collins Nwokolo says

Thanks for sharing this wonderful piece of information online and I really hope you write more like this one.

admin says

Thanks for stopping by brother. I really appreciate it. I am glad you find the information helpful.

Bryce | Sane Cents says

I feel like too many people underestimate the true power of cash flow. They think, “Oh, this car will only cost me $200/month. That’s not very much.” However, I feel that with each and every paycheck I get, it should be propelling me forward closer and closer to my financial independence goal. If it’s not being used to pay off debt (I’m not debt free), it should be used towards buying Real Estate, Stocks, or other Assets.

admin says

I cannot say it better. You have essentially summarised our whole site. Time value of money is a very important concept. Doing the heavy lifting early is key. Thanks for commenting.